You hear about the benefits of investing in your 401k all the time. It’s praised as the ultimate vehicle for retirement. Well, today I’m here to show you why you shouldn’t invest in the scam that is known as the 401k. There are plenty of opinions on the matter, but I’m just going to show you the math to make your own decisions. In reality, these funds are just another savings vehicle that someone has sold you. Take control of your money to beat the returns that a few lousy mutual funds in your 401k may offer.

The Math

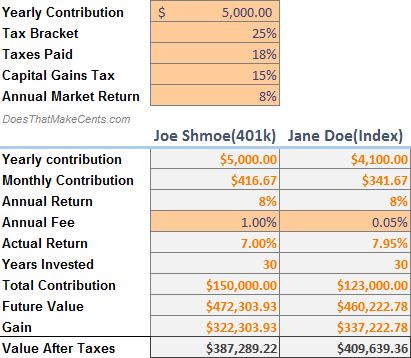

Here, I’ve created a model to prove that 401k’s, are in fact, a scam. Jane Doe beats Joe Shmoe after 30 years of using a different, simpler investment strategy than a 401k. The main factors in play here are taxes and fees. Sure, there may be exceptions, but these are average figures that actually assume those mutual funds will perform as well as the index over time(they won’t). The 401k is used to load someone else’s pockets. Let’s jump into the details.

Here, I’ve created a model to prove that 401k’s, are in fact, a scam. Jane Doe beats Joe Shmoe after 30 years of using a different, simpler investment strategy than a 401k. The main factors in play here are taxes and fees. Sure, there may be exceptions, but these are average figures that actually assume those mutual funds will perform as well as the index over time(they won’t). The 401k is used to load someone else’s pockets. Let’s jump into the details.

Taxes

I know what you’re thinking. “But Jack, we can invest in a 401k with our pre-tax income. It has to be the best deal right?” Ok, so this is the biggest advantage, but it may not be as great as you think. Let’s take Joe Shmoe who makes $50,000 per year: If Joe were to invest 10% of his paycheck, he would be contributing $5,000 per year. Now let’s say Jane Doe wants to try investing in index funds on her own outside of a 401k. She is in the 25% tax bracket just like Joe, so it’s probably safe to say she’s paying around 18% of her gross income on taxes(it’s a common misconception that people think tax bracket is the same percent they pay in taxes; not quite). This means that Jane is effectively investing $4,100 a year for retirement in index funds, $900 less than Joe. He’s got her beat there, no arguing that.

But what happens when it’s time to retire and withdraw the money??? Joe Shmoe will be allowed to start withdrawing from his 401k at the age of 59.5. These withdrawals are taxed at his income tax rate. There’s a solid chance that he’ll be taxed AT LEAST 18%, but who knows where politics and taxes will be in decades. Here’s a kicker: Joe is paying tax on the entire value of his 401k. Jane, on the other hand, is only paying tax on the gains of her portfolio. She doesn’t need to pay tax on her initial contributions because she already paid these! By the way, her tax rate will be the long-term capital gains tax rate of 15%, instead of Joe’s 18%.

Mutual Funds and Fees

Your 401k most likely only offers mutual funds for you to buy. My first and foremost reason for ditching your 401k are the fees these mutual funds charge, both hidden and unhidden. You see, these fees eat away at money that would otherwise be compounding, year after year. On average, you can expect to be paying 1-2% in yearly fees within your 401k. Effectively, this means that in a market averaging an 8% return per year, your 401k is probably averaging 7% or less. Not only that, but we are charged these fees for funds that DON’T BEAT THE MARKET +85% OF THE TIME. Google that if you don’t believe me. You can buy these low maintenance index funds that have fees as low as .02%. This is because they are just managed by a computer that aims to match the funds like the S&P 500 or the NASDAQ. Let’s say Jane’s funds average a .05% fee. This means that in a market averaging 8% returns, she will be capturing a 7.95% gain compared to Joe who is returning 7%. This may not seem like a big deal, but over 30-40 years of investing and saving, I assure you it is!

Even More 401k Disadvantages

If you aren’t sold by now, there are a few more disadvantages of the 401k. It’s not liquid!! You have to wait decades until you can even touch that money. If I ever get in a pickle or see a hot investment opportunity(probably real estate in my case), I can sell my ETF index funds and have the money in my pocket two or three days later. Joe Shmoe on the other hand, would have to pass up on the deal or pay a hefty penalty to withdraw funds. Sorry to take a dark turn here, but you could also die before you have access to your 401k funds! Maybe you hit the jackpot well before the age of 60 and you didn’t need any more non-liquid money. I bet it would’ve been nice to have a few hundred grand more to toss around before you kicked the bucket. But maybe you live a long healthy life. Guess what. You are FORCED to stop investing in a 401k once you hit 70 years old anyway! At that age, you must withdrawal everything in the fund, upon which you’re hit with taxes in addition.

Employer Matches

I’m sure a lot of you have been thinking to yourself, “Jack you’re dumb. My employer matches a percentage part of my 401k contributions.” To this, I’d say you’re exactly right. Joe Shmoe will aways beat Jane Doe if his employer gives him free money. This article is for those who don’t receive an employer match OR are contributing more than the match offered. The math above proves that there is no reason to contribute more than necessary if you’re maxing out your employer’s match.

What I Do

Maybe you don’t care but I figured I’d include this section. I’ll keep it simple and straightforward. My employer contributes 4.5% of my salary when I contribute 6%. So 6% is exactly what I contribute. No more, no less. Then I take my additional savings, and I buy low-cost ETFs like SPY or QQQ. My broker of choice is Robinhood because everything is 100% free; $0 commission on trades and no account minimums. I have an auto transfer set up to deposit money in my Robinhood account the same day my paycheck hits.

Alright guys, thanks for reading! I’d love to hear what you think about 401k’s in the comments below. I realize this article may have been pretty technical, so I’d also appreciate any general feedback you may have on this writing style as well!

Note: the example and mathematical scenario I provided above is just an average one. There are plenty more factors that could be at play. Your 401k may have funds with much lower fees or perhaps you invest in high growth dividend funds that are able to compound tax-free until withdrawal. I also realize there are plenty more retirement vehicles that could be evaluated. However, the purpose of this article was not to tell you there is absolute right and wrong way to invest, but more so to get you thinking about the math behind your investment vehicle to show that they are not always the best decision like many assume. I would create a model to match my specific scenario to make educated decisions.

Your math is a little flawed, it’s important to evaluate the taxes that you’re paying year-over-year for the things in a taxable account. Additionally note that most people, at least today, don’t work at the same employer for their entire working career, meaning that you can roll that 401k into an IRA and buy the same crap that you’re buying in the taxable account.

Additionally, most 401ks have lower cost, passive vehicles that you can invest in, which are still more expensive than what you could buy in an IRA but not a 1% difference.

Finally, you don’t even mention making annual contributions to IRAs.

Thanks for the reply Michael. A few things: I believe I do evaluate the taxes you pay year over year in a taxable account. As mentioned, Jane can only contribute $4100 where Joe contributes $5000. This is due to taxes. Otherwise, no further taxes are paid until the gains are realized and I account for this at the end of the term. You seem to be a fan of IRA’s. Me too. I’ll write about those another time, but I tried to simplify the concepts by just comparing 401k’s to regular investments rather than going into every single different retirement vehicle, as there are plenty more to cover. I agree that is possible to invest in funds with lower fees than 1%, as I do it myself. However, as I mentioned, 1% is just an average of what people are paying in their funds(some as high as 2%). Doesn’t mean they have to be.

I think scrutinizing investment options and fees in your 401k is prudent and it’s possible a 401k with no match might be a bad choice (as in your example), but 401ks in general are not a scam.

Take a look at The Mad Fientist to see a scenario where retirement account have a strong positive impact (along with tips on how to get money out before age 59 1/2).

Agreed, of course I don’t think they are always a scam, as I invest in a 401k myself. Admittedly, the title is supposed to be controversial to get people thinking and running the numbers themselves! A few may be surprised to find that they are Joe Shmoe in the scenario.

Hi Jack! While I appreciate you challenging status quo and encouraging your readers to dig into their investment decisions to ensure best performance for their needs, I must disagree with your point that my 401(k) is a scam. Here’s why: My employer provides a 1:1 match for up to 6% of my salary. Right there I am guaranteed a 100% return. Easy money. For argument’s sake though, lets assume I don’t get a company match…

I allocated my 401(k) contribution across 3 funds with various investment strategies and objectives. The weighted fee of my investments is a mere 0.04% and gross return for 2016 is 11.96%, leaving me with a net return of 11.92%. Addressing your concern that funds “DON’T BEAT THE MARKET +85% OF THE TIME”, I took a look at S&P 500’s performance over the same time period. For 2016, the index rose from 2,013 points to 2,239 points, and increase of 226 points or 11.24%. My 401(k) provided me with returns 68 basis points higher on an absolute basis or 6.1% higher on a relative basis.

Safe to say that I won’t stop investing in the “scam” that is my 401(k) anytime soon. 🙂 Thanks for the interesting content! I look forward to keeping up with DTMC!

1. Did you read my paragraph about employer matches saying that you should always take advantage of them?

2. In regard to your .04% expense ratio: nice, that’s a good plan. I mentioned that 1% is the AVERAGE expense ratio and doesn’t apply to everyone.

3. You argued my concern of mutual funds not beating the market 85% the time. I said go Google it if you don’t believe me ;). They lose 85% of the time ON AVERAGE OVER TIME. Just picking one year where your portfolio performed well is not an accurate representation of overall performance.

Thanks for reading and please let me know if you have any questions about the points made above!

Thank you for writing this article! I have been investing since my teenage years and have built a sizable nest egg for someone my age. I have been skeptical of 401ks for the exact reasons you laid out, mostly that it’s taxed as a whole and at the ordinary income rate. Anyone who knows anything about money knows that you want to make money that gets taxed at the capital gains rate. Also, my employer and many others do not match at all! So I just keep my money and invest it myself. When I tell people I do this and don’t contribute to my 401k, they look at me like I just told them I’m a cannibal. When I tell them aloud that 401ks are a scam it’s like I’m talking to north koreans or something. Thank you for outlining and confirming my suspicions! Keep up the good work.

Thanks for reading Eric! Haha I feel your pain. The numbers don’t ever lie 🙂

Jack you are spot on with this one. I saw the PONZI scheme that it is in 2001 and again in 2008. Cattle and Sheep being led to the slaughter. Government, Employers and Fund Managers change rules daily to add to their bottom lines. The individual 401 K investor has no leverage, no control and unable to react. The plan is for the insiders to siphon off profits and gains and leave working joes and janes holding the bag. That is The Plan.