How often do you see people bragging on the internet about how they’ve paid off their debt? The answer is a lot. Well, good for you Katie. You made an awesome budget and paid off your debt of $70,000 in student loans in just 3 years. Wow! Huge congrats! But guess what Katie. You probably just did the equivalent of filling a barrel with about $15,000 or so in cash, pouring gasoline on it, and lighting it on fire. Do you still feel proud Katie?? Do you?!

Everybody Hates Debt

Debt is a huge topic in today’s finance realm probably because 80% of Americans have it with the average household owing about $90,000. That’s a lot of people and a lot of debt! Over the years, during various economic cycles, the word “debt” has come to own a very negative connotation. People hate debt, they don’t want to talk about it, and they especially don’t want to owe any. If you ask me, I think people approach debt too emotionally. We all know people who invest emotionally make the worst investors, right? I think I’ll go the mathematical route.

Debt Is Not Always Bad

Getting rid of debt has become popularized by personal finance gurus like Dave Ramsey. These guys preach about how bad debt is while they quietly make over $100 million by selling their books and courses to you and me. Do they help people? Sure. But my beef with Dave Ramsey is that he was wildly irresponsible with his money, didn’t understand smart investing, hit rock bottom, and then stood on the mountain-tops claiming that owing zero debt is the only way you can live life successfully(here come the angry comments from Ramsey fans). He’s convinced thousands of people to pay off their mortgages early, without explaining the math to them and how they may actually be losing money by doing this.

Think Mathematically, Not Emotionally

The short version of this entire article can be summarized by the following sentence: You should not pay more than the minimum debt payment if the interest rate on it is a lower percent than the returns you could be earning elsewhere. To be more direct, it doesn’t make mathematical sense to pay off debts that are less than 8%, which is what you could probably be earning in the market at a minimum. This will include debt like student loans, mortgages, and most auto loans. The reality is that this is cheap money to borrow, so if you understand investing and compound interest, then you probably understand why investing is better than paying off cheap debt. If I borrow $10,000 at 5% and I’m using it to invest in stocks earning me 8%, then I’m profiting 3% on this money that’s not even mine to keep.

The Math Behind Paying Down Debt Vs Investing

Remember Katie? Here are some facts:

- She had $70,000 in student loans to pay

- The loan was a 10-year term at 5% interest

- Her minimum payment was $742 month

- This is probably high, but I want it to be comparable to those reading this doing something similar with a mortgage

- Her awesome budget left her with $1350 each month to either invest or pay down debt

- She chose to pay down debt and did so in 3 years

- This route only cost her $5,543 in interest after 3 years

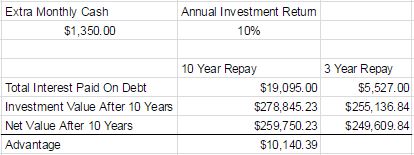

Pretty sweet, but let’s see what Katie missed out on. While she was only paying $5,543 on student loan interest, she was missing out on earning about $19,111 in interest on her potential investments! Therefore, we can say that Katie essentially took $13,568 in cash and lit it on fire. You can go check these or your own numbers here. I personally prefer to do all of my work in excel so here is a quick summary:

Note: I didn’t account for the tax advantages of having more interest to write off, which is why my numbers are not the same as quoted above. This was just a quick and dirty model. I think I’ll add a calculator to this page in the future if there’s enough interest to know exact figures for different scenarios.

When To Pay Off Your Debt Before Investing

When writing on a controversial subject like debt, I feel like I should include this section so I’m not ripped apart quite as much in the comments. You should pay off your debt before investing when:

- The interest rates are higher than 10%(like credit card debt)

- Your job is not secure and you can’t stomach the risk

- You desperately need to raise your credit score

- You’re old/retiring wealthy, so there’s no need to risk investing

That’s all I can think of for now, but let me know if there are any more reasons why you should pay off cheap debt rather than investing. After all, aggressively investing instead of paying off my $50,000 in student loan debt allowed me to reach financial independence at 22!

I read your six most recent articles. I just wanted to say that your topics, writing style and approach are refreshing. I’ve looked through close to 200 personal finance blogs in the last couple weeks and yours really stands out. You take some “conventional wisdom” and stand it on its head or point out the nuances that most other bloggers seem to miss. If you keep this up, I can’t imagine you won’t attract more page views in the future or succeed in what ever other goals you have for this blog.

Wow thanks a lot man, I really appreciate the encouragement. Going to check out your blog now!

I think another reason to pay off debts is to free up cash flow. If you’re barely making ends meet, it makes sense to pay down debts to eliminate a monthly obligation. Also, if your income isn’t stable.

I don’t think all debt is bad. Sometimes it makes sense to divert your money elsewhere. I would love to not have a mortgage, but right now the people who rent my basement through Airbnb are paying my mortgage for me, freeing up extra money for me to save or invest.

An outstanding share! I have just forwarded this onto a colleague who

was doing a little research on this. And he in fact ordered me dinner because I stumbled upon it for him…

lol. So let me reword this…. Thank YOU for the meal!!

But yeah, thanx for spending time to discuss this issue here on your website.

Hahaha that’s awesome. Enjoy the meal! Glad I could help 🙂

It’s all very logical, and mathematical, but even I as a professional engineer make more decisions by emotion than logic. And that’s why Dave Ramsey is a phenomenon. I agree you are correct, but he will change more lives than we will because he attacks the root problem fur so many, which isn’t debt, but is immaturity. Great blog, and there is a very specific audience that can learn a lot here.

I too am a fellow STEM employee. I can’t disagree with you there. Emotion is a lot easier to start with handling if you don’t understand the numbers. Thanks for the kind words as well.

I was suggested this website by my cousin. I’m not sure whether

this post is written by him as nobody else know such detailed

about my problem. You’re incredible! Thanks!

That’s awesome! Glad I could help. Feel free to reach out any time.

Math! Who knew! Haha. Been meaning to have something like this written up myself!

I don’t even know how I ended up here, but I thought this post was great. I do not know who you are but certainly you’re going to a famous blogger if you aren’t already 😉 Cheers!