Well, I did it. The whole purpose and goal behind this blog has been accomplished. I still don’t enjoy writing, but these timeline snapshots have been super helpful to look back on, so I figured this was an important time to do it. I technically quit my job a month ago(March 15th, 2021). It’s been a long time coming and I kept on pushing the date back but I’m officially free from the shackles of corporate America!

Life

First, I’ll summarize where I’m at in life with any changes since my update last August. I’ve lived in Jax beach for one year now. Second best decision ever; convinced I could live here forever. I have a new girlfriend that I’m obsessed with. We’ve only been dating for about 3 months now, but between us, I’m sure she’s the one. Further developments to come here. Health is still important but I’ve been very injury-ridden the last several months so that sucks. Life from Covid is pretty much back to normal as many people are getting vaccinated. I haven’t yet, since I already had the virus, and don’t believe I’ll get it again. Alright, let’s get to the numbers.

Income

I quit my job when I had just been bumped to a 92k base salary. Passively, I am estimated to make about 63k pretax, so I was likely on track to make somewhere around 155k annually. Not bad, starting at 62k 5 years ago. Coincidence that I’m now back to making original income except passively this time 5 years later?! I’ll break down my current income.

My real estate portfolio nets $3600/mo, $530 of that is a real estate note. I took out a HELOC that is at about 5% interest and loaned it out to a friend(secured real estate note) at 12% and 3 points. Would love to keep doing this. I also make about $1700/mo from Parks Technologies LLC, as I just acquired replied.app for $18k. I’m hoping to improve this site and increase revenue further. That is my main day-to-day currently. So, that brings my passive income total to about $5,300/month. I was finally comfortable enough to retire with this number because I’ve now tracked my exact expenses for one year!

Expenses

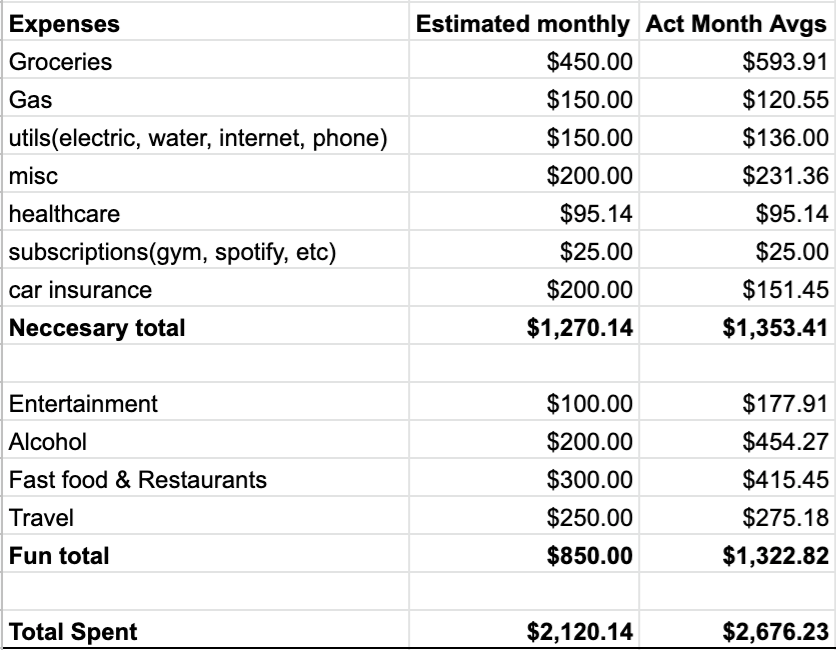

Here’s the breakdown. It’s interesting to compare my estimates with my actuals. Groceries were higher than expected; I use a meal delivery service that costs me around $80-100 per week. Still seems like my grocery expense is higher than it should be🧐. Otherwise, my necessary expenses were pretty accurate estimates. The fun expenses were all underestimated. If I could dial back on the alcohol budget we’d be looking solid. Please note that I’m not buying 20 cases of beer per month, but spending this at the bar on drinks for myself and friends. I just like to include this number to shame myself and keep myself in check but I’m not sure it’s working. Kind of wild my overall food budget is over $1000/mo. Yikes.

So this average income, minus taxes, minus average expenses means I’m netting an average of $1814.53 per month! Wow, that’s well past fire, and ultimately seeing this number down on paper is what gave me the confidence to quit my job and not look for a new one. Of course, I’ll never be able to sit completely still, as I feel that I’m not fully free unless my future spouse can retire on the income as well. The income will need to be increased to support a more lavish lifestyle than the one I currently live, renting out four of the bedrooms in my house.

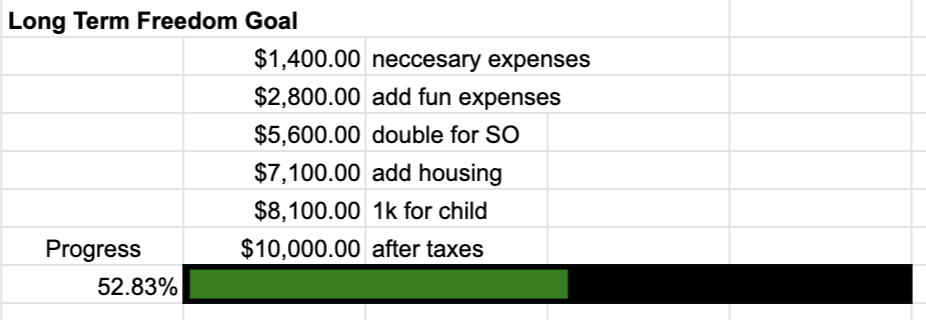

I’ve decided 10k/month is my goal. This number is pretty arbitrary, but here’s some napkin math to justify it. We all need a goal to work towards right? So in my retirement, I plan to find ways to increase my income by about $4700 more per month. This will likely be through investing in businesses, real estate, websites, or notes.

Net Worth

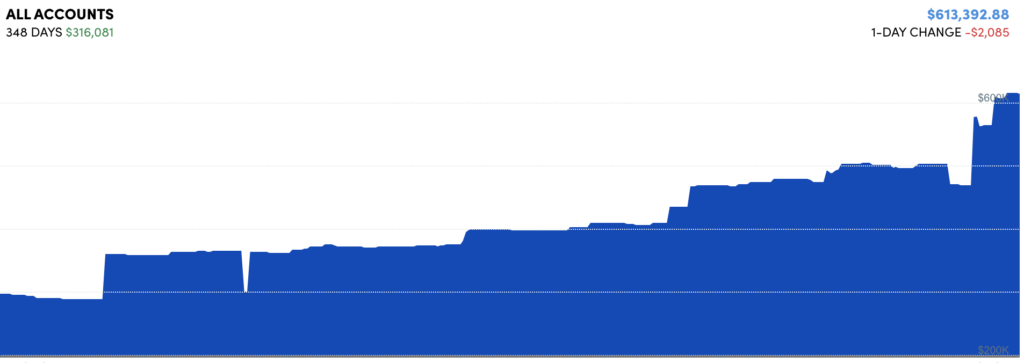

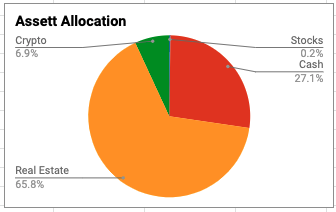

Woah, my net worth has gone up over 200k in the last 8 months, when I typically have been average 100k increases each year. Is compound interest finally starting to kick in?!? This drastic increase is mostly thanks to some good real estate appreciation and appraisals/refinances that have occurred since last August. Crypto hasn’t been doing too bad either. Here’s my current asset allocation below. Whoops, I probably need to get back into the stock market. I cashed out my Roth 401k upon quitting the job since I only used it for the company match.

The 4% Rule is Dumb

I think I’ve previously expressed my beef with the boring and slow game of retiring on the 4% rule, but now I can debunk it fully through the case study of myself. To summarize if you aren’t familiar, the fire community has decided that you save up enough money until you have enough where withdrawing 4%(this 4% is backed by data over time in regard to inflation and market returns) of your portfolio each year will cover all of your expenses. If your expenses are 5000/mo or 60k/year for the rest of your retired life, then you’d need to accumulate $1.5m. How long will it take you to save that much money?? Even a high earner and great saver would be lucky to get there by 40! How much will you have missed out on by not being retired in your 30s? I was able to match this $5000/mo in passive income by investing in income-producing assets like real estate and businesses. I was able to produce this income with a 600k net worth rather than 1.5m. This isn’t a brag, it’s a wake-up call. I am not that intelligent. I graduated college with a 2.9 GPA and it’s not because I wasn’t trying hard enough. I’m also not that driven. I play volleyball 5 days a week instead of working. So here’s the cliche; if I can do it, anyone can do it. Screw saving up for the 4% rule, go buy some assets.

Happy retirement to me.