In my opinion, this is one of the most overlooked methods to help you reach financial freedom. Everyone assumes it’s too difficult or it’s not right for them. Let me show you how easy it is to live for free by putting a roof over your head without paying for rent or a mortgage each month with a trick called house hacking.

How I Started

Here’s my story. I had just graduated college and landed my current full-time job. It was only about 45 minutes from the college house I was renting. So naturally, I procrastinated getting a new place since my current lease still had another 2 months or so on it. With about a month a left on my lease, I decided to start looking for a new place to rent that would closer to my job. So, I go to Realtor.com, type in my city, and hit Search. Guess what! I was on the “Buy” tab and forgot to change it to “Rent”. Silly me. But I was shocked at how affordable the homes in the area were! 9 months, one primary residence, and 10 rental units later, here I am because of that dumb mistake. It’s a true story! Check out their interface. Easy mistake.

My First Purchase

Sorry I got sidetracked there. So anyway, I’m accidentally scrolling the real estate for sale in my destination area and then I look up a mortgage calculator. Rent was cheaper than a mortgage! Bless the low cost of living in the South(sorry to those in places like NYC or San Francisco, but keep reading; hope isn’t lost for you). Some people suffer from analysis paralysis. I suffer from shiny object syndrome. After running the mortgage numbers on these properties and seeing what I could afford, I made an offer on a condo a few days later. After a painful negotiation process(I’m a cheapskate), I landed the 2 bedroom condo that I live in now.

House Hacking

That’s right, a 2 bedroom condo! I found an old friend from school who needed a place to live. Now, he rents one bedroom from me while I live in the other. This is what the real estate community refers to as house hacking. To do this even more efficiently, I could have(and should have) purchased a 2-4 unit property and rented out the other units while living in one. I’ll explain the absolute best way to house hack down further.

The Numbers

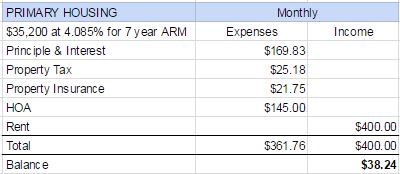

Now the good stuff! I said I was living for free, and by now you’ve probably realized I just meant that I have a renter to pay my mortgage for me. After I pay the mortgage(principle and interest), property tax, property insurance, HOA dues(yea, don’t get a condo), I am profiting $38 each month after I charge rent. Here it is straight from excel:

Most of my friends are paying about $800 per month to rent their 1 bedroom/studio apartments. In my eyes, that means I automatically take home at least $838 more than them each month! That’s over $10,000 per year. It will actually equate to more than that because of the tax advantages I’ll get, but nobody wants to dive into taxes right now.

Do Better Than Me

The truth is, I made a ton of mistakes in this process and there are far better ways to house hack. But if anything, that’s a testament to how valid this process is, if I can make it work with a ton of mistakes and no real estate knowledge.

Mistake #1 – Buying a condo. A condo is much less likely to appreciate in value than single family home or multifamily. You will pay monthly HOA dues that eats up your profit. The HOA can charge you random “special assessments” which basically means they don’t have enough money to pay for something expensive like a new roof or other capital expenditures. Those are just the financial negatives. I could add more negatives about having to live by the management’s rules or the lack of privacy, but those would just be emotional factors. They are also tougher to sell, which brings me to the next mistake.

Mistake #2 – The financing. Long story short, it’s harder to get a condo financed ever since 2008, as banks tend to stay away. For Jack the buyer, this means that my terms on my mortgage are not very good. Had I bought a house, I could’ve put down as little as 3% instead of 20% like I did. I also could have gotten a fixed rate mortgage for 30 years at 3.25% instead of an adjustable rate after 7 years that is at 4.085% like I got. For Jack the seller, this means the price is driven down on my condo because fewer people can get/afford financing for it.

Mistake #3 – Not buying a fixer upper. I would love to go back in time to buy a property for cheap that I could fix up. Even if I couldn’t do it all myself, paying a contractor would still have set me up much better financially. I bought a freshly flipped(poor job, but I didn’t know it at the time) piece of real estate for retail value. As all the financial freedom chasers know, you can’t succeed without making investments at a discount.

The Best Way To House Hack

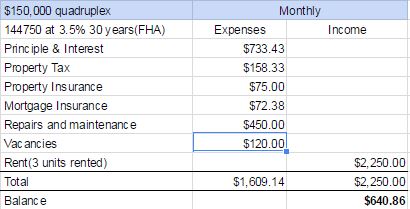

Now that I’ve outlined my main mistakes, here’s exactly what I would do, and what I’m trying to find: A fixer-upper, 4 unit(quadruplex) with an FHA loan. I just bought a property like this in another state, so unfortunately, I can’t live in it to receive an FHA loan. But let’s make a quick model to see what would happen if I could have bought a quad for $150,000 and lived in one unit to get an FHA mortgage.

So not only can you live for free, but you could profit about $7,700 a year. The best part? That’s about the same amount you would have had to put down to get this property with an FHA loan(3.5% down plus closing costs). We call that a 100% cash on cash return. Tell me where else you can find these returns and I’m ditching real estate to invest with you!

The Excuses

I already know people will have reasons not to house hack so here are my prewritten responses:

“I can’t afford the down payment.” An FHA loan is only 3.5% down. If you wrap closing costs into the loan, you can get a $100,000 house for $3,500.

“I won’t qualify for a mortgage.” If your credit is below 500, you’re right. Otherwise, qualifying will not be too difficult, regardless of your income as long as your debt/income ratio isn’t out of control. This is because FHA mortgages actually allow you to count the expected rental income in your qualification process!

“I don’t know how long I’ll live here.” So when the time comes to move, you can sell. Hopefully, your property has appreciated in value. Option 2 is to keep the property and hire property management. They will take about 10% of gross rents; very worth it to me.

“I don’t want to manage tenants.” See above; hire property management.

“I can’t live in a multifamily because of my wife/family.” Can’t help ya here. Happy wife, happy life! According to my dad anyway.

Let me know what other arguments you may have so I can try to add to this list!

Thanks for reading, everybody. Subscribe or let me know what you think in the comments below!

This is so informative! Thanks for the post!

Thanks for reading Tara!

this is great advice! I have been toying with the idea of buying my own condo, and i have had similar excuses, but now ill have to look into it on a more serious level! Thanks so much!

Thanks for reading! Be careful with those condos. Can you tell I’m biased against them because I own one? Lol, either way, buying a condo is still better than doing nothing if you want to house hack/invest!

These are awesome tips! I catch myself saying all of those excuses. What would you say to someone that has student debt though?

I still have 50k in student loans to pay off, so you aren’t allowed to use that excuse 😉

I’ll explain: I have student loans to pay off, but they are at a low fixed rate. My investment returns(including RE) are much higher than the interest on my student loans, so why rush to pay them off? I make the minimum student loan payments and invest the rest, as this is the best mathematical way to approach the scenario. I realize that a lot of people approach debt emotionally rather than mathematically though! I try not to.

Having lived frugally all my life – I am in absolute agreement. It is possible to live happy and finacially free, but it does take thoughtfulness to carefully look at your goals and how to achieve them.

hey jack! this was a great read. it all comes down to the numbers, as you broke down so nicely. i’m looking into investing now that my student loans are paid off (freedom!!) but may have to look outside of NYC for the numbers to make sense. what other articles of yours would you recommend? thanks for sharing~

Congrats on paying off your loans! I think this calculator could be useful to you once it’s time to buy. Other than that, I’ve tried not to bias too many of my articles towards real estate(it’s hard!), but I believe this one best summarizes my overall mindset when it comes to personal finance and freedom. https://doesthatmakecents.com/easy-way-retire-early/

Jack and I regret selling a condo we once owned near a college. We could have rented it for years and had the thing paid off for my daughter who now goes to that college. She could have had paying roommates and we would have made a profit! Grrrr. Ah well, hindsight is 20/20! Great post, BTW.

–Jenny

http://yeahwesaidthat.com

The number one regret I hear in the RE community: “I wish I hadn’t sold.” Haha you aren’t alone!

And property is the best kind of investment too. Have any tips for the UK?

Don’t think I have any authority to speak on RE in the UK, but I think most of these concepts should still apply just the same except for the FHA mortgage. Regardless, house hacking this way with a more conventional mortgage will still be better than the other alternatives!

Great article! Comprehensive, thorough. Thank you! I learned a lot and am inspired to BUY….the right away!

Great to hear; let me know when you do!

This was really nice to read. I’d love to do this but I’m a foreigner in my country and they do no loan to foreigners

Ahhh. We actually are acquiring a property right now that someone from the UK holds the mortgage on. Maybe look into international private lenders! Currency exchanges can work in everyone’s favor sometimes.

Love the idea. Your numbers look solid.

Thanks Dave!