Make a budget blah blah blah. We’ve heard it a thousand times. Everyone knows they should, but only 32% of American households prepare a monthly budget. It turns out that only 70% of these people are actually checking to see what they spend compared to their budgets. That equates to about 22% of American households who follow a budget. 1 out of 5. Why don’t more people do something that is so obviously good for their financial well-being? Because budgeting sucks!

Making The Budget

I have to admit, I feel like a hypocrite titling the article this way. I have a budget on my Mint account and I check it weekly. I’ll explain later. After graduating college, I was stoked to make a budget because I’m a total finance nerd. It bothered me that I couldn’t make one in school. Believe me, I tried. Some months I spent $50, others I spent $500. There was just no way to stay consistent with football seasons, spring breaks, random trips, etc. So I graduated and thought, “finally, life will be boring enough for me to make a budget and stick to it.” So that’s what I did! I made a budget, estimating at first, and then nailing it down after about the third month. It took some trial and error. Those first few months were a contest for me; to see how little I could spend each month. Everyone else got a job and started spending money like a drunken sailor while I got a job and started making competitions with myself to spend less and less. By month 4 of the real world, I was spending a little over $900 a month. It was pretty ridiculous.

Let’s Get Spending

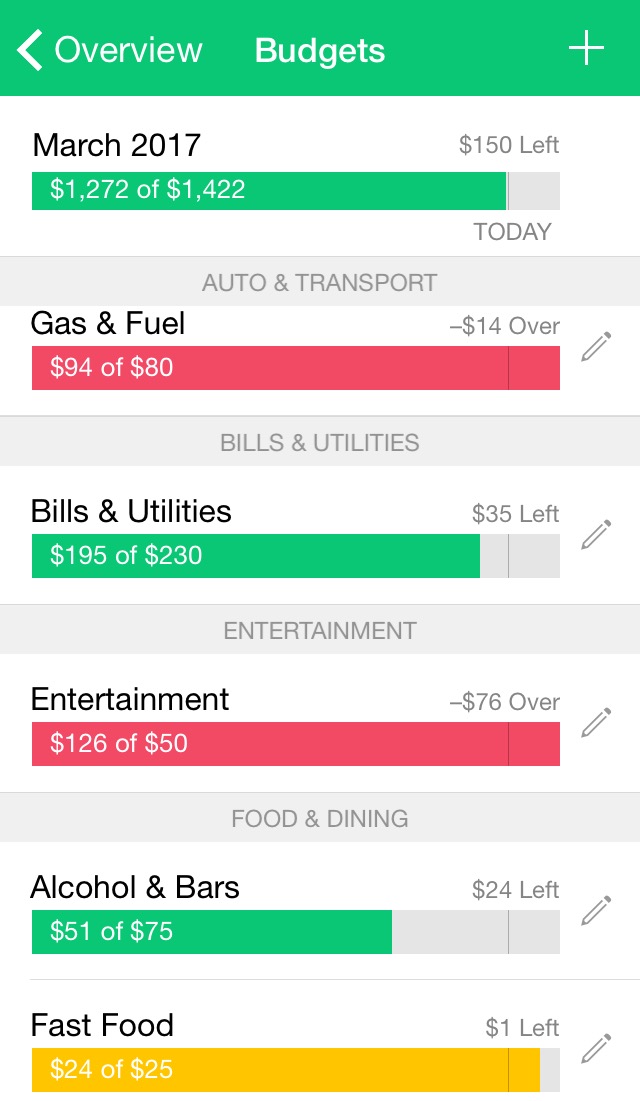

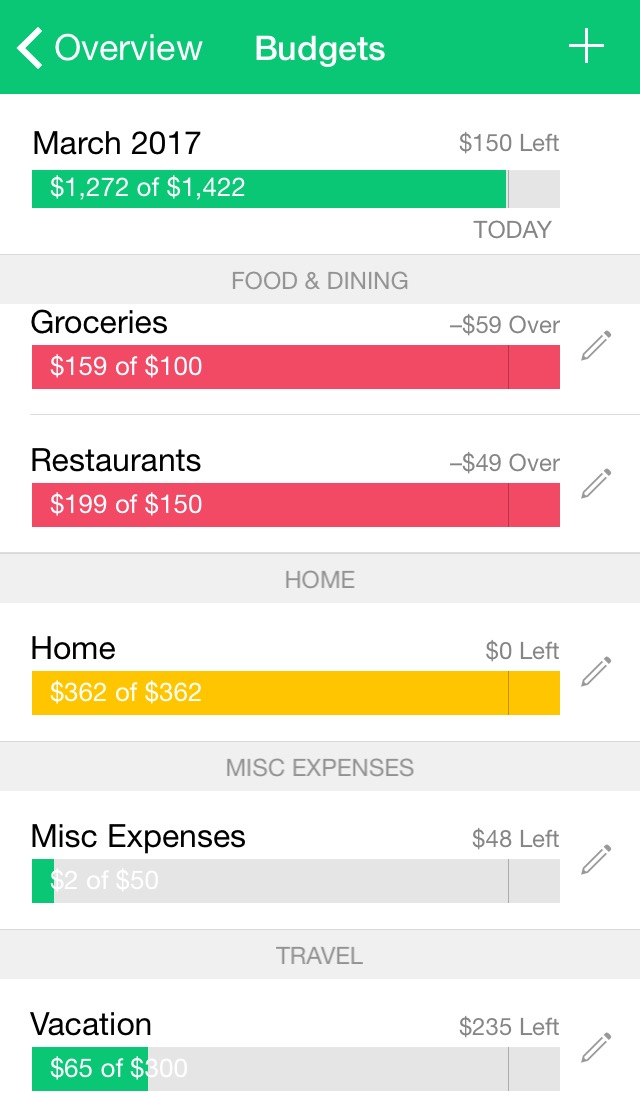

For anyone wondering, my base annual salary at the time was $62,000. I was saving about 75% of my take-home dough! And it sucked. I quickly grew to realize that this lifestyle was not sustainable. I felt guilty anytime I would go over my budget, and even turned down social events to save the money. What was I thinking? I was a year out of college with a secure job and trying to live as boringly as possible to save a few dimes. I kick myself looking back, but I’m glad I realized it pretty quickly. So how did I combat this compulsiveness of extreme budgeting? I added vacations, entertainment, alcohol, and restaurants to my budget. I literally pay myself to do these things now. I’m not joking! See for yourself.

My Budget

My Budget

Today is March 28th and it’s almost the end of the month. My spending categories seem to vary from month to month, but look where that tiny little line at the top is, out of $1,422. It’s right where it’s supposed to be! This seems to happen month in and month out, where I’m within a hundred bucks of my budget every time. I’ve learned to accept my inconsistent spending because my bottom line turns out to be about the same. However, now I know that I need to be weary of going out to eat too often(honestly, I say that every month about my “restaurants” budget). Sidenote: my groceries are usually about $100 on the nose but I tried shopping at a new grocery store this month. Needless to say, I’m resuming my shopping at Walmart next month. Despite being over my restaurant budget by about $50 this month, I just got home from dinner and drinks with some co-workers. I’ve come to realize that these social interactions, both for fun and for networking, are both great investments in myself and well-being. I added $500 to my budget just for those reasons.

Check Yo Self

The switch went off for me a few months ago when a friend told me “leisure is just another form of currency.” Now, I couldn’t agree more. So you might be asking, “why do even bother to keep a budget then?” I keep it for a few reasons. The main one is because I want to know exactly where all my money is going. Even if I don’t follow my budget to T, there’s no doubt that being aware of my expenses helps to keep them under control. I hope my girlfriend doesn’t mind me using her as an example :). She ended up tracking her expenses, understanding where her money was going, and then spent $1,000 less the next month. By just becoming aware, she was able to easily choose the things that she could afford to spend less money on. The next reason I track my expenses is probably different from most people. I like to know how much passive income I need to retire. Figuring this out is pretty easy if I’m gauging how much money I live on each month. You can learn more about that in my article about the easy way to retire early.

Don’t Save More, Just Earn More

Remember how I said I was saving about 75% of my take home pay at first, when I was only spending $900 a month? Well, then I started spending $500 more each month. So I guess now I’m saving closer to 60% of my take-home pay right? NOPE! I’m still saving 75% of my take-home income because investments and side hustles have allowed me to create about $20,000 more in gross income. I think I probably sound too arrogant now, so let me try to clarify my point. You can try and try and try to spend $50 less each month, OR you can go and try to earn another $50 a month, and then not stress over breaking your budget by that $50. I think the majority of people can cut plenty of fat off their monthly expenses and they won’t miss it. But once you’ve cut enough fat, you can only save so much more and it’ll get exponentially harder. Instead of trying to pinch pennies, start looking for ways to earn more money. Maybe you can pick up an easy side hustle or maybe you can switch jobs to earn more.

Money Buys Happiness

Several studies have concluded that money does, in fact, buy happiness. However, the point at which a person stops gaining happiness from money is about $70,000(this was a study conducted by Princeton and a few others). Of course, that’s just an average amount and everyone’s mileage will vary. My point is, budgets suck and can make you unhappy. So, rather than complain and suffer from your penny-pinching budget, get off the couch and go make more money!

Thanks for reading guys. I look forward to your feedback. Here’s one of my favorite money quotes from one of the most prestigious financial psychologists in the world:

“Money doesn’t buy happiness.” Uh, do you live in America? ‘Cause it buys a WaveRunner. Have you ever seen a sad person on a WaveRunner? Have you? Seriously, have you? Try to frown on a WaveRunner. You can’t!”

Joking, it was actually Daniel Tosh who said that. Still funny.

Can I borrow your wave runner? 🙂

Love this post – keep up the great work.

Haha anytime! Thanks a lot.

Good post, Jack! You mentioned you consistently go over budget in your restaurant spending. But, your grocery budget is pretty low. We spend $350 to $400 month for two people which I don’t consider to be very extravagant. And buying/cooking food for two averages out less per person than just planning for one, in my experience.

I’d be frowning on WaveRunner. Within 5 minutes I’d be in pain from sunburn. Oh the curse of the fair skinned!

Thanks for reading! Yea, most people seem to be surprised by my grocery budget. Buying Great Value brand at Walmart tastes the same as the name brands to me 🙂

Well, at least you should be smiling for the first 5 minutes lol

I strongly agree with the idea that most people can find tons of “fat” to cut out of their spending, but once you reach a certain point it just becomes inconvenient and non-beneficial to attempt to save more. Once you reach a low spending level, the next best step is to simply earn more. I have applied this reasoning in my own financial journey by picking up side hustles and increasing my income, which makes me feel less guilty when I splurge on something I want. Awesome article!

Exactly! At one point, I found myself spending way more time trying to save pennies that could’ve been used to earn dollars. Thanks a lot for reading!

Earning more money is definitely one way to go about easing up a budget. However, earning $50 is not the same as cutting $50 in expenses. Most people in the world pay taxes, which means that cutting $50 is actually larger than earning an additional $50.

I especially liked your point on how spending $500 on social activities and fun are great investments in yourself. I need to start doing that more, as I’m currently in that super frugal phase of just saving / investing a lot of money. Did you start spending on yourself more overnight or was it a gradual transition?

You make a good point here! I guess you’d have to earn more like $65 to be equivalent to cutting $50. Nevertheless, that’s still the route I’d prefer.

I actually started spending more on myself overnight. It started one day when I decided to add vacation, restaurants, alcohol, and entertainment to my budget. You know how many people say to pay yourself first? Well, it sounds like you and I both have the problem of saving everything we can and paying ourselves last. I don’t think this is always a bad thing, as our long term goals should be accelerated. However, I’ve found that adding these fun expenses to my budget has been a nice compromise to paying myself first rather than last.

Good post…did you create that budget graphic/tool yourself? Or where might I find it? I created my own in excel but not totally happy with it.

Thanks for reading! This is an app on my phone called Mint. It syncs with the web version that does all the same things at Mint.com

When I was digging my way out of debt, I thought the budget feature on Mint would be very helpful. In reality, I kept going over my budget areas, and not meeting my goals, and would receive annoying emails about that. So then I would tweak my budget categories to fit my actual spending, to avoid getting the dreaded red highlighting or annoying email. So that totally defeated the purpose of budgeting, and I eventually got rid of Mint. I have a much better system now: I make all of my transfers on pay day to meet all of my saving/investing goals, and leave enough in my checking to cover bills and groceries. If I didn’t “pay myself first”, there wouldn’t be any money left at the end of the month. I agree that it’s important to include entertainment and vacations in your budget. If you don’t plan for those things, you either feel deprived or you cheat your budget (like I did) to sneak those things in.

This is interesting, as I was reading an article just the other day about how budgets don’t actually work. The article claimed that understanding where your money is going is what helps the most psychologically. I couldn’t agree more, seeing as this is the exact reason I use Mint. The red bars don’t bother me much. I just have peace of mind knowing what every dollar is spent on.

Great article! Back when I was earning above average, I don’t need side hustles back then. Those are the days I don’t know the word budget and saving up. I spend at least $300-$500 monthly for social events and networking. It was also the time I knew everyone and everyone knows me. Everyone is good to me and was always with me. But the moment I switched to frugal and thrifty lifestyle, it’s as if everyone left! For now I only have 3 friends left, 2 college friends and one colleague from my first job where I earn the lowest, the start of my career. Anyway, I learned the Budgeting 101 the hard way. But it was never too late. I am still glad I made it! I just saw your article, and I said to myself Jack is right! I still need to live a life and don’t need to deprive myself of anything. Everything spending is in moderation now…