TRANSPARENCY! Here’s my total financial picture after a year of pursuing financial freedom, as of August 2017. I’ll outline my progress in the workplace, real estate, stocks, passive income, side hustles, and everything in between. Please feel free to follow up with questions and suggestions at the end. Let’s do this.

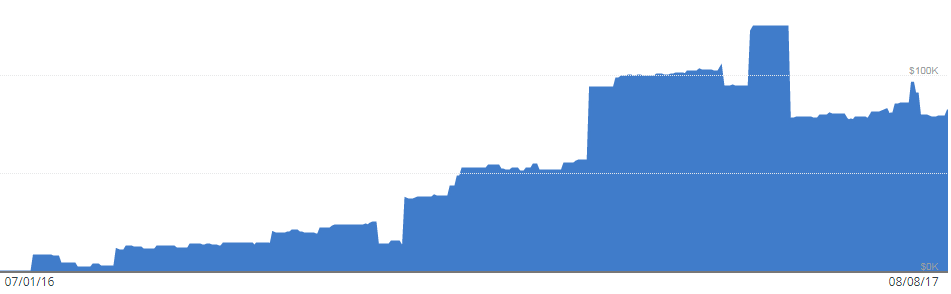

First, here’s a net worth graph. It’s a little choppy because of real estate and adding 50k in student loans about halfway through when they should’ve been included from the start.

This chart shows my last year of progress. As of today, my estimated net worth is $82,319.11 – note that this figure is extremely variable with it being so heavily allocated in real estate, as we are constantly buying, rehabbing, or refinancing. So this estimation includes what I believe to be the equity in my real estate portfolio today.

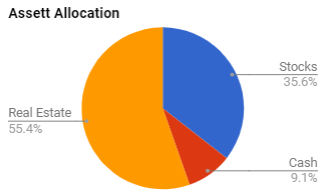

That brings me to the next visual, my current asset allocation. I keep 85% of my stocks in index funds like SPY, QQQ, and other Vanguard index funds. The other 15% is in an options account that I just irresponsibly gamble with. I wouldn’t recommend this strategy with any more money than you’re comfortable losing. Future Jack will probably read this and disapprove, but in the meantime, it’s fun. My cash allocation is getting a little higher than I’d prefer, but I’m hopeful that the next real estate deal is around the corner. Note: student loans are part of my net worth but not asset allocation.

W-2 Job

The shackles of the cubicle in corporate America. Hopefully, in the future, this section won’t be included 🙂

Salary: $82,000

Some of you may remember how I tricked a company into hiring me last year. Joking…sort of! When I first started, I was being paid a base salary of $62,000. Luckily, I was able to trick them into promoting me as well.

Annual 401k Match: $3,690

I was not contributing to my 401k since it wasn’t matched. Check out this post if you want to hear me rant about 401k’s. Now that I’ve been there for a year, they match 4.5% of my first 6% contributed. Not great, not terrible.

Healthcare bonuses: $1,590

Through various optional programs and company HSA contributions, I was able to make back some of my dollars that I spend on health insurance.

Expected YoY income increase: $21,590

This figure represents my subtotal improvements since I started work full-time after school.

Real Estate

My current real estate allocation consists of equity in my primary residence, 2 multifamily’s split with my business partner, and one quadruplex split with my parents.

Portfolio Value: $238,000

This number is only MY held value, as most of these properties have been co-purchased.

Portfolio Equity: $69,250

This is the net amount I would walk away with if I were to sell the portfolio and pay off the mortgages.

Portfolio Equity Added: $60,000

This is an estimate of my net worth increase due to adding value to real estate through rehabs and good purchases. This figure summarizes why I believe real estate to be one of the most efficient vehicles towards wealth.

Portfolio Cash Flow: $1,139/month

At the time of this writing, 9 out of 10 units are filled and this net cash flow subtracts the mortgage and assumes a 40% expense ratio. This is definitely subject to change as the portfolio expands and gains some years, but this should be a safe starting assumption. My gross rental income is $2,820, which matters not in the slightest.

Expected YoY income increase: $13,668

Monthly cash flow multiplied by 12. This is mostly passive, as property management handles tenants and rent collection.

Stocks

Portfolio Value: $43,552

This is the sum of my Roth 401k, ESPP, the individual account just for index funds, and my options account. This number was at zero at the first of June, as I just got back into the market. The bank account was hurting from rapid real estate purchases, but things have slowed down.

Portfolio Gain: 24%

Despite missing out on significant market gains for the first half of 2017, my portfolio in entirety is up about 24%. This is largely due to great company stock performance with my ESPP, some lucky options plays, and the new 401k match. I don’t expect this performance to continue. Over this same period (1 year), the S&P 500 is up about 13.5%.

YoY Gain: $7,852

Hmmmm….way less effort and not too far behind the passive real estate income. I’ll have to keep an eye on that. Based on these numbers, I should be flipping the properties and then putting profits into the market rather than holding them as rentals. But we’ll see how stocks and real estate continue to perform.

Other Side Hustles

Aside from the real estate company, I’ve also started an inflatable rental company and a technology company. There’s less positive performance to report here.

Investment: $2231

Originally I typed “Loss” before I decided to change it to “Investment” ;). I’ve spent about $1,500 on a freelance developer to help me with an app that I’d like to hopefully sell. It’s probably 70-80% complete for Beta launch. About $200 has gone to miscellaneous items like a host and equipment. I also spent $500 launching an inflatable rental company with 2 others. This was mostly for fun and a learning experience. It turned out to be a much more active business than any of us had anticipated. Anyone looking for a bouncy house to buy??

YoY Revenue: $501

My tech company made one website where the client pays a recurring amount each month. We also rented the bouncy house one time. Fingers crossed that I’ll be able to increase this number with the launch of the app, but we’ll see.

Summary

Total Expected Income Increased YoY: $43,610

This is a complicated number that I really just wanted to know for myself. This is the minimum additional amount that I expect to earn this year going forward as a result of my activities/sacrifice this previous year. So this includes my salary increase, rental income, stock gains, and side hustles. Had I not actively pursued all of those things and just put my 62k salary in the bank, this number would be zero.

Yearly Passive Income: $17,318

Say I quit my job – this is what I would expect to passively earn next year from real estate, side hustles, and stock gains(assuming passive index funds).

Yearly Living Expenses: $16,560

Lower than the passive income number!!! Pretty cool. Note that this does not include my real estate or business venture costs. But if I were to stop adding to the businesses, this is what I would spend since I’m living on an average of $1,380/month. You can see my full budget in this post.

Savings Rate: 76%

This is the percent of my take home income(total of all streams after taxes and expenses)I am saving or investing each month. As the great MMM says, this figure is the most important factor in reaching early retirement.

Thanks for reading! Give me your questions and/or suggestions regarding my current progress and investment techniques below!

Nice YOY increase and savings rate. Your’re doing something right! (Actually, you’re doing many things right.) Keep it up.

Thanks a lot!