Half a decade of doing this money thing! This update feels much different, considering I’m actually “retired”. In quotes because I work more now than I have in a long time. I’m having a blast with the tech businesses right now. Funny how that works; my focus shifts between real estate and tech depending on the economic climate, and right now you can’t buy any cash-flowing properties anywhere since they’re priced so high. Notice I didn’t say overpriced, because I have suspicions this could be the new normal for real estate, as hedge funds and tech companies seek to control the inventory. We’ll see how this take plays out. I think it’ll cool off but we have an influx of buyers from Covid since folks weren’t buying last year.

Life

Quick life update since the retirement post for my records: Coming up on a year and a half of living in Jax Beach. I’m still dating the girl I claimed was the one in my previous post. Covid Delta is picking up right now but it seems like people don’t care as much. I’m still unvaccinated but might be in the minority at this point. I may in a month or so since a cruise is requiring it. As far as my day-to-day is going, I’m playing sports about 3-4 days a week, hanging out with my girlfriend every day, and mostly working on the tech businesses for 6ish hours a day. The two projects taking up the majority of my time right now are replied.app and gymbet.app. I bought Replied about 6 months ago for 18k and have worked a lot to improve it. I’ve just started developing GymBet. We’ll see how it goes. Hopefully, it’s not a failure like OfficeFlows, but I’ve actually restarted that as well. I’m not very optimistic about it, as the target audience seems unclear and now the UI seems outdated, but maybe I’ll figure it out. I’m also spending time looking for more businesses to buy. My partner and I almost bought a tile cleaning business but I decided I’d prefer to invest in tech and maintain a more remote lifestyle.

It looks like I included some health updates in the last one so let’s get to those. I’m a little bummed because injuries have held me back in the gym this past year and I’ve basically stayed stagnant. I’m sitting at 155lbs today which is about exactly the same as last year. I will note that I think I’ve decided I don’t want to do the heavy bulk and then cut anymore, as I review pictures of myself and see how out of shape I looked. It’s wild to think that I look ok at the time but upon current review, I was gross lol. I am feeling grateful that my injuries have mostly gotten better. My joints are feeling much less healthy than they used to with elbow and knee pains but at least I’m back to being active on a regular basis.

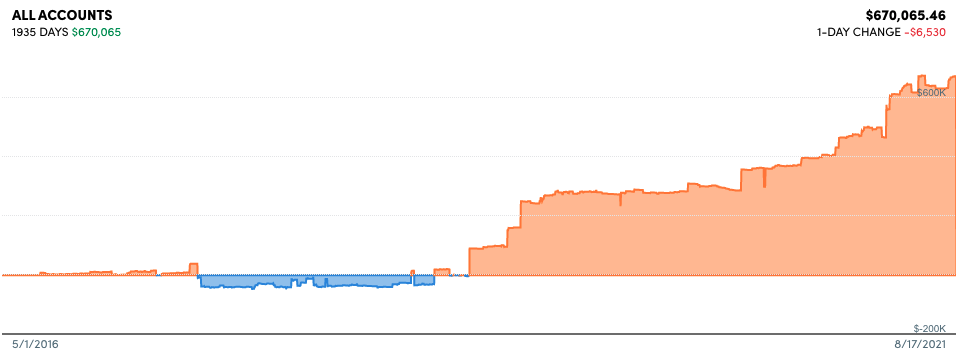

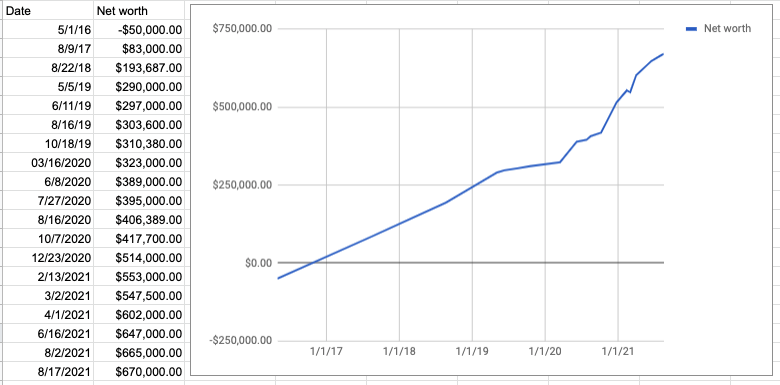

Net Worth

After 5 years as a college-graduate working adult:

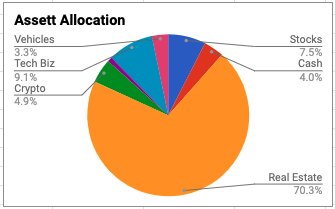

Here’s the allocation:

The 70% allocation in real estate looks about the same, but the remaining. I have about half the cash but one difference from last year is the 100k HELOC I have available now.

The little purple sliver is what I have in a gold index.

Real Estate

Last year I had my hand in 22 units, and this year I have 20. We unloaded some more. Yikes, 2 years in a row of my portfolio decreasing. As bad as this seems, I’m excited about where it’s at currently because all units remaining are the winners and there are no headaches with management. It’s on autopilot and spitting out $4,000 a month, up from $2,700 last year. $870 of this is a note that I loaned %87,000 on. It’s at 15% APR which I really like, as it’s completely passive. Might look more into this in the future.

Portfolio Equity: $492,400

Portfolio Cash Flow: $4,000/mo

Stocks

This is gonna make some people very upset. When I quit my job, I withdrew all of my Roth 401k. I was aware of the penalties and the vested amount I’d owe. Whatever, even with those penalties, I’m confident that I can find a higher return in businesses or real estate opportunities. So now, I’m sitting at exactly what my allocation chart shows.

Total gold, stocks, and crypto: $93,000

This means that if I had to because an opportunity arose, I could have about 220k liquid including this, my cash, and my HELOC.

Tech Businesses

I mentioned replied.app previously. I purchased it for 18k. Initially, it was making about $1500/mo but Covid was a big part of this. Today, it’s on track to make $3,650 this month with $2,750 as profit. This is a 183% cash-on-cash return! Obviously, this wasn’t passive, but I’m still very pleased with this. I’m currently trying to buy another website for about 80k. As you can see, my shiny objects this year are apps and websites. I think I’ll probably stick with this, as it’s very freeing to be making money remotely with no physical ties(like real estate but even more so). GymBet is just now starting development(I received the first few page designs today), so we’ll see how that progresses.

Income and Expense

Since I sort of retired, I actually have been tracking my income and expenses to the penny, since it’s much more important now to know if I need to seek reemployment. Let’s dive in.

YoY Expenses: $32,328(this doesn’t include housing since it’s a part of the rental portfolio).

Interesting to note that my 12-month trailing expenses are very similar to last year, being $2,694 this year.

Current Net Income Pre Tax: $4,222

This income number is an average of the last 4 months, as that’s when I started tracking incomes to the penny. RE is making $3900 of that. I’m pumped about that number because my models predicted that I should be making $4000/mo on average and this means it’s a pretty accurate model. Also, the tech NET income is so low because of all the ads trials and current development work I’m doing. If I just let things sit as is and stopped spending money, that would make my passive net income equal to $6,700 or 80k/year. That would leave me with a 60% savings rate at completely passive!! Realizing this just now is pretty exciting. But let’s go the more pessimistic route. We do need to include my development expenses. And I have taxes to pay. So my real net income after tax averaging the last 4 months is about $3,588. That still means I’m in the green by over $800 each month, but definitely more humbling.

Retirement savings rate: 25%

What a change this is! But hey, I don’t need to work if my income is passive so it really wouldn’t even matter if this was 0%. But is this my end game? Absolutely not. I have to plan to earn enough passive income to support a wife, kids, and whatever toys/house I want down the road, as I can’t rent out 4 bedrooms forever. I have decided that I want to make 150k/year as fully passive income. I’m 55% of the way there. Note that when I first decided on this last year, I just wanted to make 72k/year passive income. I guess I’m feeling more ambitious now since I already hit that number.

Same concluding paragraphs 4 years in a row?? Sure, here ya go.

I am very sorry if you made it to the bottom of this trainwreck of a post. I used to spend hours double-checking and rewriting things, but as I mentioned, my interests have changed and this was really just for me to record my progress to look back on! Maybe I’ll retire early, get bored, and write here all the time. Who knows! Just stick with me anyway 😉