From last year’s update:

Let’s just accept this blog for what it is.. and that’s a journal that I use to summarize my finances and life once a year because it turns out the first two updates were actually helpful to me when I wanted to look back and remember my net worth, allocations, or whatever. So let me quickly summarize the life updates since last year.

So as of today, I’ve been living in Jacksonville for 1 year and 7 months. I’m really starting to love this place. A few differences from last year: I just moved to the beach 4 months ago – right in time for summer and it’s been a blast. I don’t want to say that I wasted my time living in Mandarin(South Jax – 30 mins from the beach) buttttt wow I’m way happier now. I’m starting to get a little bit concerned about my productivity levels(deja vu from Greenville?), as volleyball, surfing, and friends are just extremely accessible. I bought this house, added 2 bedrooms a full bathroom, and now rent out 4 bedrooms. So with 5 mid-twenties guys living in one house, it can be a slight shit show. People keep calling it a frat house. I do my best not to let it have that reputation but I don’t know if it’s working. Sometimes I have to put up with messes that aren’t mine(which hurts because I’m pretty clean) but man the financials are juicy; I’ll get into those later. I would be remiss not to mention that I’m back to living the bachelor life without a female roommate like last year. There’s no tea on the breakup, just Jack being Jack!

I wanted to make a few more points about my life currently since these have proven to be very interesting/helpful for me to look back on. Mentally, I’m as happy as ever and maybe the happiest yet? This may or may not be because of the awesome summer I’ve been having with a lot of new friends living at the beach. I’m currently weighing 154lbs which is the lightest I’ve been since 2015. I don’t know if this is good or bad but I dropped 20lbs by cutting when the gyms closed for quarantine. Oh yeah! I have to talk about the rona some: to be honest, it hasn’t been much of a factor for me other than those couple months with no gym. I’m one of the ignorant ones that isn’t worried about a pandemic with a mortality rate under 1%. That’s the general consensus among Floridians and my friends but we’re still all doing this ridiculous thing where we wear a mask for the first 10 seconds upon entering the gym/restaurant/bar and then can take it off.

Also, I’m planning to quit my job October 18th to pursue some previously mentioned tech ideas/website business. October 18th is the day that I can pull a HELOC out on my new primary home(6 months after purchase). I’ve been saying I’ll quit forever so we’ll see if I really do. Although this is the first time I’ve set a hard date. Actually this week, my boss an HR bombarded me saying they were going to put me on a corrective action plan since my performance was declining hahaha they’re on to me. I probably put in about 20-30 hours of work on the software job lately. Now on to the good stuff!

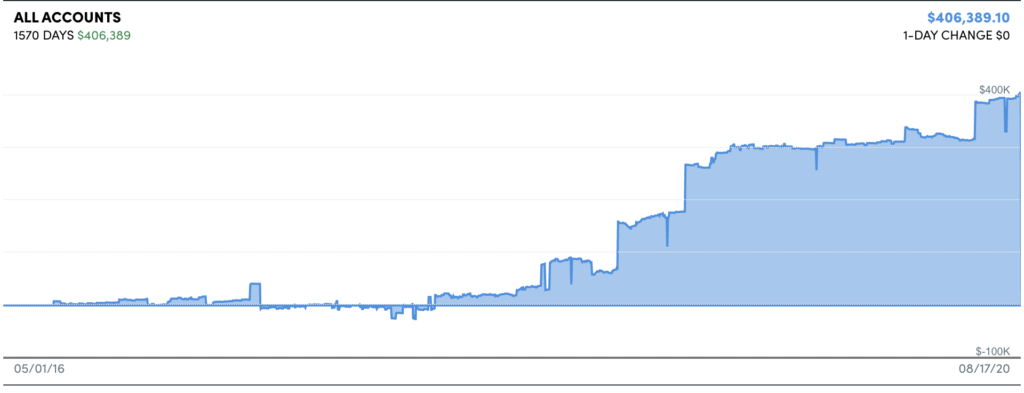

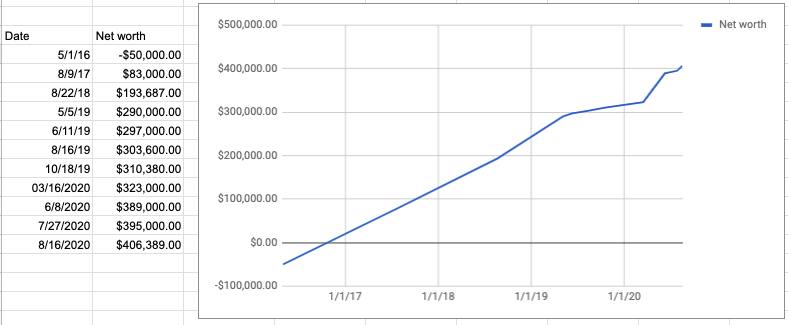

Here’s the updated net worth chart after 4 years of work:

From last year: By the way, I really have beef with Personal Capital for the way they handle deleting accounts. The only thing accurate about this chart is my current net worth. The history is incorrect because when I close an account or remove it from PC, they remove all of the history as well. End rant. Also, I’m a sellout, so here’s the link to sign up and track your net worth. We’ll each get $20.

Once again, my net worth chart remains linear.

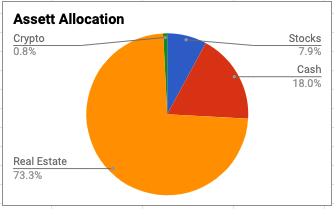

Updated asset allocation. This looks a little healthier than last year. We’ve unloaded a couple of flips and rentals and I’m currently sitting around 75k cash. This is more recent after selling my live-in flip. I should probably invest this asap, although I would love to pounce on the next real estate opportunity(hopefully apartments).

In the pipeline currently – we are selling our triplex in South Carolina which should close this month, so maybe a little more cash and less real estate but not much difference since there’s little equity in it.

W-2 Job

Salary: $82,820

No change. I mentioned I plan to quit October 18th. Will this count as my retirement? Mission complete?

Real Estate

In the last 4 years, I’ve been involved in 21 transactions…um what?? My post last year said 22. I’m extremely confused. I must’ve miscounted. I really need to get better at documentation I guess. Anyway, I currently have my hand in 22 units. 3 less than last year – makes sense since we unloaded some things. And actually it’s about to be 19 if the triplex closes. I’ll note here: covid has kind of slowed down our business. We can’t get into properties as easily. We’ve just recently trimmed our expenses by 2000/mo as we realized we we marketing a lot but not necessarily seeing the expected results. We dropped our office lease, acquisitions manager, assistant, and expensive marketing software. We tried the go big or go home approach and overall I’d say it failed. Now we’re back to being lean and have plenty of cash to jump on the next opportunity. It’s a bummer that we didn’t blow up despite putting in a lot more money and effort, but I have no regrets trying. I will add that it’s much less stress currently without all of that overhead.

Portfolio Equity: $318,600

This is MY net amount I would walk away with if I were to sell the portfolio and pay off the mortgages.

Portfolio Cash Flow: $2700/month

WOOOOO!! I’m pumped about this. Last year I was netting $600. This dramatic improvement is mostly due to my new househacking(grossing 2700/mo in bedroom rentals while my PITI is 1700) and (almost) finishing and filling that 8 unit apartment complex in South Carolina. I’m also really excited about this because I just technically just hit financial independence as $2700 is what I’m currently spending monthly. Honestly, it should be only $2000 but I go out way too much – I’m working on it.

Stocks

Portfolio Value: $34,000

This is just my 401k increase. I’m not investing otherwise.

YoY Gain: $7,300

This year, my Roth 401k returned me a $7000 gain between company match and market growth. I still contribute to my ESPP, which spits out $4,000 per year. I didn’t do any solo investing. My crypto is up to $3500 from $2100 – still down from the $5000 I put in in 2018. Since I’m a sellout, here’s a link to create a free Robinhood account. That link comes with a free stock.

Other Side Hustles

From last year: The shiny object this year that I lackadaisically work on is an Instagram bot. It seems people are paying good money for this and it’s relatively easy to develop, so why not throw my hat in the ring? At this point, 40 people subscribed from the ads I put up($50 expense). I haven’t finished the platform and don’t even know if I will. See how I learned from my mistakes of my last failed project? I’m making sure I’ve done the marketing and have a proof of concept in place before I burn $8,000 🙂

Another failed one! Instagram cracked down big time right after I tried to throw my hat in the ring for automated bots. Figures. Oh well, I’m back to white hat practices, as I just got another website customer at $45/mo. I’m really considering pursuing this further once I quit my job. I mean 20 websites at $50/month is another passive $1000/mo…hmmmm shiny objects.

Summary

The last few months I got my Mint account back on track! This is because I wanted to see if would actually be able to retire. So for the last 4 months, I’ve been averaging $2700 in expenses(does not include mortgages, as these are deducted from my passive income).

Yearly Living Expenses: $32,400

This is assuming I continue to average $2700/month. Hmmmm interesting that in my 2017 update, this number was about half that…. I know 5k of that 16k increase is food, but honestly I feel way healthier on these meal plans and love not having to worry about cooking. 1k increase on car insurance(ouch, new truck). But where is that other $10,000 increase coming from? I have to assume I’m spending an extra $10,000/year on my fun budget. Yikes, but also I do recall that I hardly went out or vacationed that first year working.

I stopped using mint, so unlike my last annual report, I do not know my savings rate or living expenses. I also don’t have my passive income numbers recorded, but I do have the estimates that my excel sheets give me. I really need to get back on track huh…anyways:

Yearly Passive Income: $33,000

Like the expenses, this is taking the the 2750/mo that I’m at now and multiplying by 12. Hey look my income is higher than my expenses; I’m free! The irony here is that I said the same thing in 2017. I was definitely more naive about my income and expenses though and feel like I have a much better grip on actuals this time. Still a wake up call that I need to find balance on my $17,000 yearly fun budget. Is this too high?? I’d actually love to hear some feedback on where others in the FIRE community spend on fun.

Savings Rate: 69% – nice

After assuming my yearly expenses at $32,000, this rate is calculated by finding that I make $102,000 after taxes. $70,000 saved divided by $102,000 earned. Down from the 76% in 2017, this has confirmed the infamous lifestyle creep, as I am certainly making more than I was in 2017.

Same concluding paragraphs 3 years in a row?? Sure, here ya go.

I am very sorry if you made it to the bottom of this trainwreck of a post. I used to spend hours double-checking and rewriting things, but as I mentioned, my interests have changed and this was really just for me to record my progress to look back on! Maybe I’ll retire early, get bored, and write here all the time. Who knows! Just stick with me anyway 😉