Another year, another neglected blog. Let’s just accept this blog for what it is.. and that’s a journal that I use to summarize my finances and life once a year because it turns out the first two updates were actually helpful to me when I wanted to look back and remember my net worth, allocations, or whatever. So let me quickly summarize the life updates since last year.

I’m still averaging 15 hours of work a week, but now I’m fully remote, which brings me to the biggest change. I moved to Jacksonville, FL on January 15, 2019. This move was 100% for real estate, as this market seems to be less competitive than the one I was in(Greenville, SC). Last year, I hardly worked and I just went out or played volleyball all the time. Since moving, I’m probably back to putting in 40+ hour weeks on the real estate business with my partner, going out only a couple times a month, and playing volleyball 1.5 times per week now. Alcohol budget has surely decreased dramatically! 🙂 I also bought a new truck which is huge for me because I really expected to drive my Mazda into the dirt, but alas, I need a pickup for the home renovation activities. This new to me but my biz partner is teaching me a lot on the rehab side by working on both our houses. Wanna hear something funny? I moved into his house at first and then bought the one directly across the street. Now we’re doing live-in flips on both of them at the same time. Final and probably most important update: my girlfriend moved in with me(lol hey B, we wild).

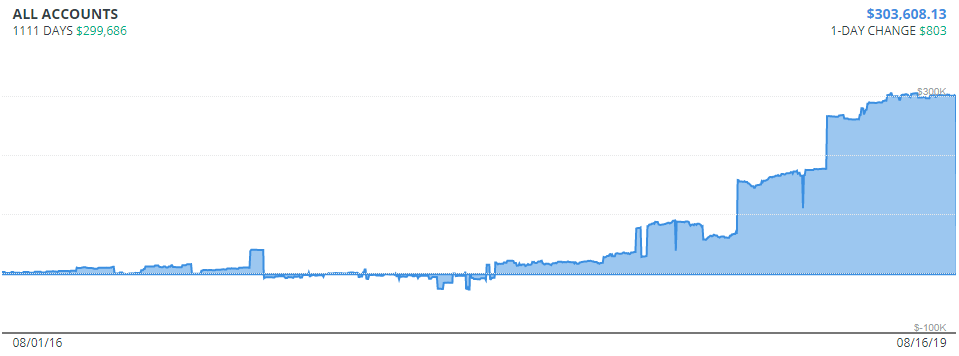

Here’s the updated net worth chart after 3 years of work:

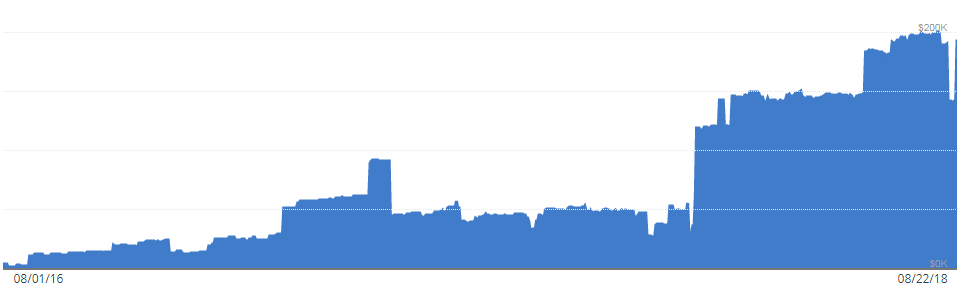

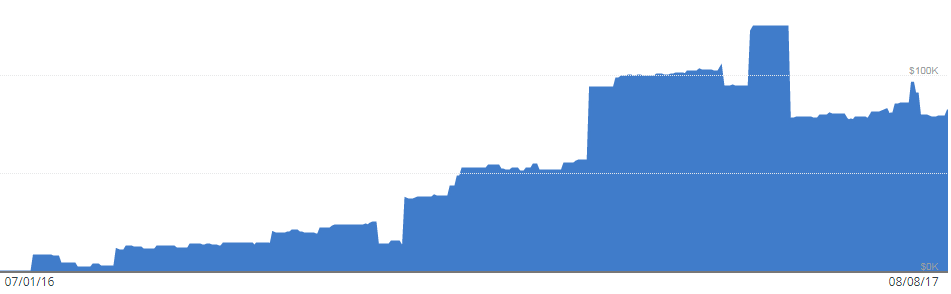

By the way, I really have beef with Personal Capital for the way they handle deleting accounts. The only thing accurate about this chart is my current net worth. The history is incorrect because when I close an account or remove it from PC, they remove all of the history as well. End rant. Also, I’m a sellout, so here’s the link to sign up and track your net worth. We’ll each get $20. I’ll include the previous two years charts to help get a better idea of progress.

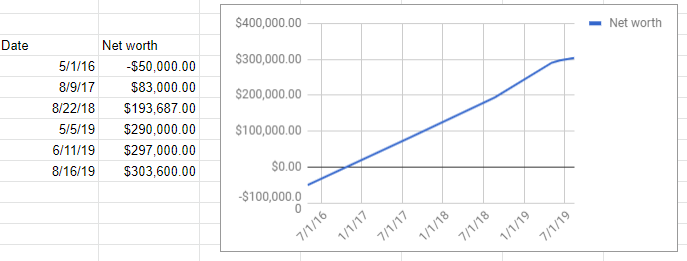

So at this point, it looks like I’m just on a fairly linear path of increasing my net worth 100k each year. When is this exponential compounding thing gonna take effect???? Actually, I might as well just plot it myself – should be helpful in future years.

Wellllll, that’s the least exciting chart I’ve ever seen. Moving on.

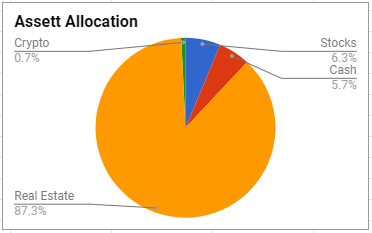

Updated asset allocation. Ya boy’s net worth is gonna be hurting when this next market crash comes huh?? I’ll document this now: I think we are reaching a plateau. I don’t think we will see a crash in the next decade. Can’t wait to see if this is true when I read it in 10 years.

To be fair, I have one flip on the market, a rental that we purchased and rehabbed with all our own cash that will be refinanced soon, and a primary residence undergoing rehab. So this should look much more cash-heavy in a few months.

W-2 Job

Salary: $82,820

A 1% RAISE WOOOOOOOHHHHH. This is why you create other streams of income, folks. Or I could’ve probably worked harder at this job?? Nahhhhh.

Real Estate

In the last 3 years, I’ve been involved in 22 transactions, which is 10 more since last year. I have my hand in 25 rental units to date, which is 11 more than last year(8 unit apartment building contributes to that).

Portfolio Cash Flow: $618/month

For some reason, this number goes down every year. Ok, I can explain. The flip I just put on the market is included with a $1,000 mortgage. My new primary is $800/mo. The 8 unit apartment just finished rehab and will start to fill up soon. Needless to say, I’m pumped to see what this number will be soon. If it goes down again next year, I’m quitting real estate.

Stocks

Portfolio Value: $21,055

A little less than the $115,000 from last year. I liquidated it all to invest in RE(again).

YoY Gain: $7,300

Last year, my stocks returned me $15,470. This year, my Roth 401k returned me a $5000 gain between company match and market growth. I still contribute to my ESPP, which spits out $4,000 per year. My regular index fund investing lost me $2,100(the market went down when I invested and up when I needed to pull it out for real estate purchases – very cool). My crypto has hardly moved since last year(up $400). Since I’m a sellout, here’s a link to create a free Robinhood account. That link comes with a free stock.

Other Side Hustles

The shiny object this year that I lackadaisically work on is an Instagram bot. It seems people are paying good money for this and it’s relatively easy to develop, so why not throw my hat in the ring? At this point, 40 people subscribed from the ads I put up($50 expense). I haven’t finished the platform and don’t even know if I will. See how I learned from my mistakes of my last failed project? I’m making sure I’ve done the marketing and have a proof of concept in place before I burn $8,000 🙂

Summary

I stopped using mint, so unlike my last annual report, I do not know my savings rate or living expenses. I also don’t have my passive income numbers recorded, but I do have the estimates that my excel sheets give me. I really need to get back on track huh…anyways:

Yearly Passive Income: idk. It’s Friday evening so I need to get a life. Maybe I’ll finish..don’t hold your breath.

Is it cool if I just copy and paste the ending paragraph I used from last year? I think it still works. Ok, here ya go.

I am very sorry if you made it to the bottom of this trainwreck of a post. I used to spend hours double-checking and rewriting things, but as I mentioned, my interests have changed and this was really just for me to record my progress to look back on! Maybe I’ll retire early, get bored, and write here all the time. Who knows! Just stick with me anyway 😉